Do Australian businesses have to accept cash?

By Tom Watson

"Card, cash or cheque?" There was a time - a few decades ago, to be fair - when paying the bill with any of these three payment methods could have been the norm.

Of course, that is no longer the case. Cheques have almost gone the way of the dodo. On the other hand, debit and credit cards in either physical or virtual form have become the most prevalent payment method in Australia.

But what about cash? A glimpse at cash usage rates, which have steadily declined over the years, suggests that the heyday of notes and coins is also behind us.

What that trend doesn't show is the desire that some Australians have for maintaining cash as a widely-accepted payment option though.

Take the Federal Member for Kennedy, Bob Katter.

Earlier this year Katter made headlines after being told that he wouldn't be able to pay for his lunch with a $50 note, as the Parliament House café he was dining at no longer accepted cash.

Katter stated at the time that businesses have to accept legal tender under law, describing the decision "...to not accept Australian legal tender, in the very place, that makes the laws to accept cash as a form of currency" as an embarrassing flaw.

He also argued that many Australians don't want, or can't afford, to see cash phased out, and pointed to power outages in the wake of recent natural disasters and sporadic failures to payment systems as examples of why cash should remain a viable option.

So do businesses actually have to accept cash as a form of payment, and what could the future hold for cash payments in Australia?

Cash on the decline

Before getting into either of those questions it's worth laying out how Australia's preference for using cash has changed over the years.

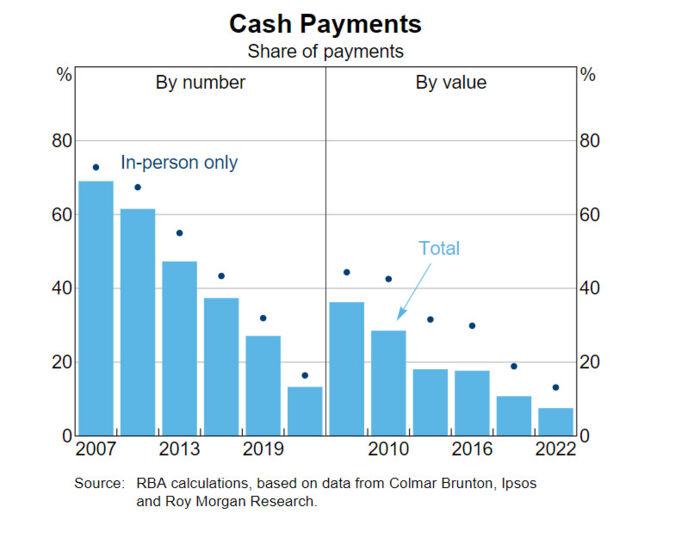

In 2007 when the Reserve Bank of Australia conducted its first Consumer Payments Survey, nearly 70% of all in-person payments were made using cash. By 2022, when the most recent survey was conducted, that figure had fallen to just 13%.

The decline had been relatively steady for many years, but it really sped up between 2019 and 2022 as a result of the pandemic.

"During the pandemic a lot of business only accepted cashless payments to curb the spread of the virus. This accelerated the transition because the practice ended up staying for a lot of business and becoming a habit for consumers," explains Dr Angel Zhong, an associate professor of finance at RMIT University.

"The other reason that's driven this is the variety of cashless payment choices we have and innovations in technology in the payment space.

"We now have a variety of choices starting with PayID, Apple Pay and Google Pay, and let's not forget that Australia is actually the birthplace of large scale buy now, pay later products which have an important place in the cashless payment space."

While most in-person payments were made with cash a little over a decade ago, just one in 20 survey participants used cash for all of their transactions in 2022. In 2019 it was one in ten.

Interestingly, the Reserve Bank also found that the decline in cash use has occurred across demographic groups. It's not only younger and metropolitan Australians who are giving up cash as a form of payment, but older and regional Australians as well.

Is it legal for a business to refuse cash?

As cash use has declined and card payments have become the go-to for many at the checkout, plenty of businesses have also made the decision to go cashless.

It's not just café's that have moved away from taking cash either. Some of the country's largest sporting venues, like the Melbourne Cricket Ground, Stadium Australia and the Sydney Football Stadium, for example, are now all cashless.

This is perfectly legal according to the Australian Competition and Consumer Commission (ACCC). Businesses can choose which payments they want to accept, whether that's only cash, only card, or a mix of payments.

In the same way that card surcharges need to be displayed prominently though, businesses also need to make the available payment options clear.

"It is legal for a business to specify the terms and conditions that they will supply goods and services," the ACCC states on its website.

"This includes whether they will accept cash payment. However, consumers must be made aware of these terms and conditions before they make a purchase."

But why are businesses allowed to refuse cash if it's legal tender? As the Reserve Bank explains, notes and coins don't have to be permitted as a form of payment even though both are classified as legal tender.

"Although transactions are to be in Australian currency unless otherwise agreed or specified, and Australian currency has legal tender status, Australian banknotes and coins do not necessarily have to be used in transactions and refusal to accept payment in legal tender banknotes and coins is not unlawful."

Could Australia become cashless?

With cash payments on a downward trajectory and some businesses phasing out cash as a payment option, could there be a point in the future where cash use goes the way of cheques?

"If we look at look the growth trajectory it's very likely that by 2030 more than 95% of payments will be cashless," says Zhong. "So my prediction is that by 2030 Australia will be a functionally cashless society."

As Zhong explains though, there's an important distinction between a cashless society and one that is 'functionally cashless'.

"When we say functionally cashless it means that the dominant type of payments are cashless payments. So people will still be able to use cash and it will still be legal tender, it's just that most people won't be using it."

While cashless payments are likely to become even more of the norm in years to come, Zhong agrees that cash has, and will continue to have, an important place.

Part of the reason for that is that cash continues to be a critical payment method for many, especially among groups without high levels of digital literacy. Another factor is that some Australians simply lack access to the kind of stable internet needed to make cashless payments reliable.

"This is why the transition won't happen overnight. It will happen gradually and there will be pain points which I hope the government and community groups can work to address," Zhong says.

"For example, in helping older generations to embrace technology by improving digital literacy, and also to build better infrastructure to support this innovation in technology.

"We need to balance the need for efficiency with the need to ensure that essential services remain accessible to all Australians."

Get stories like this in our newsletters.