Australian equities

Australian shares are the most popular asset class for investors thanks to privatisations and the power of dividend imputation and franking credits.

- Australia's sharemarket is valued at almost $2 trillion.

- Investors make money from shares in two ways: from the change in the price of shares and from dividend payments.

- Dividend payments are concessionally taxed by a system known as dividend imputation and franking credits.

- Franking credits are special notional payments investors receive to compensate them for the tax already paid by companies before paying out dividends on which investors have to pay personal income tax.

Australian equities are shares in companies listed on the ASX. These companies, for the most part, do most of their business in Australia, although many also earn income from international operations.

Shares represent part ownership of a company and give their owner a share of the company's profits, which is the portion left over after deducting the cost of running the business, the cost of its debts and the payment of corporate tax.

The value of Australian shares available on the ASX as at December 2021 amounted to a staggering $2.6 trillion, which is bigger than the value of the entire Australian economy.

The ease with which investors can trade shares on the ASX and the large volume of company shares available helps explain why Australian equities are Australia's largest investor asset class. But this popularity is also significantly boosted by taxation concessions available to investors, known as dividend imputation and franking credits.

Australia's sharemarket

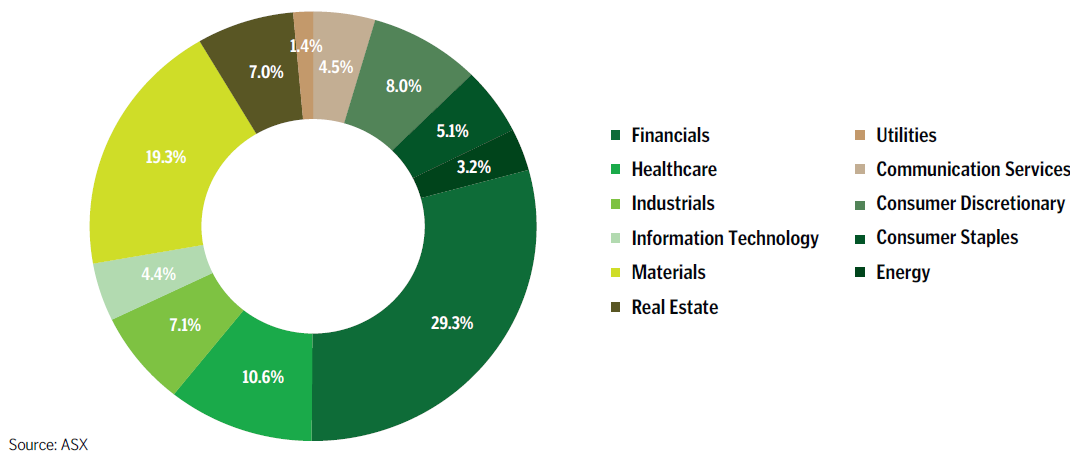

Australia's sharemarket consists of 11 major sectors that reflect the activities of companies available on the ASX: financials, materials, healthcare, industrials, consumer discretionary, real estate, consumer staples, energy,information technology, telecommunication services and utilities.

The largest sector is financials - this includes the banking sector - which makes up 29% of the ASX market value, followed by the materials sector, which makes up 19% - this includes commodities-based manufacturers like steel makers and miners. Healthcare makes up 11%, with consumer staples at 5%, industrials 7% and real estate 7%. These six leading sectors comprise almost 80% of Australia's sharemarket.

Dividend imputation and franking credits

To encourage people to invest in Australian shares, in 1987 then prime minister Bob Hawke and treasurer Paul Keating introduced a taxation concession system that allowed Australian investors, when calculating the taxation liability on their Australian share investment earnings paid as dividends, to take into account the tax that companies have already paid on their profits. In practical terms this means investors only have to pay the difference between the lower company tax rate and their marginal personal income tax rate.

For example, if an investor is liable to pay a 45% marginal personal taxation rate and the companies in their Australian shares portfolio paid an average 30% tax rate on their profits, then the investor would only have to pay 15% tax on the dividends they received from these Australian company shares.

Meanwhile, a self-managed super fund that is liable to pay tax at only 15% would receive a 15% tax credit, because while their Australian company share earnings have already been taxed at 30% their SMSF tax rate is 15% lower.

ASX share market segments - 2021

To perform this adjustment - taking into account the tax already paid on company profits from which the dividend payments were made - companies gross up their dividends by a notional amount known as a franking credit.

Franking credits are available only to Australian investors. They ensure that dividends from Australian company shares are not taxed twice, that is, the investor does not pay personal income tax on Australian company dividends paid from profits that have already been taxed. Dividend imputation and franking credits can reduce the amount of tax paid by Australian investors and may result in a tax credit where the Australian Tax Office gives the investor a refund.

If an Australian company pays tax to foreign governments on the portion of its profits earned overseas, this diminishes the amount of overall profits subject to Australian tax, which leads to a reduction in the franking credit available to Australian investors. This reduced franking credit is known as a partial franking credit.

ASX segment breakdown in more detail - December 2021

| Investment Return | Largest companies in segment | |||

| ASX segment | % of ASX | 1 year | 5 years pa | |

| Financials | 29% | -6.3% | 1.6% | Commonwealth Bank |

| Materials | 19% | 18.2% | 21.9% | BHP |

| Healthcare | 11% | 4.1% | 18.1% | CSL |

| Industrials | 7% | 11.3% | 11.6% | Transurban |

| Real Estate | 7% | -0.3% | 6.5% | Goodman Group |

| Consumer Discretionary | 8% | -4.6% | 7.0% | Westfarmers |

| Consumer Staples | 5% | 6.2% | 11.1% | Woolworths |

| Energy | 3% | 57.8% | 24.2% | Woodside Petroleum |

| Communication Services | 4% | 4.6% | -4.4% | Telstra |

| Information Technology | 4% | -27.6% | 3.0% | Comptershare |

| Utilities | 1% | -16.7% | 3.6% | APA Group |

Source: ASX, Rainmaker Information

How you make money from Australian sharesThere are two main ways investors make money from owning shares in Australian companies: 1. Change in valuation of the share price - if the company is worth more now compared to when you bought your shares, the difference represents how much money you have made from owning those shares. 2. Dividends paid, company earnings or net profit - when companies earn profits, some of this is paid out to shareholders in the form of dividends. The rest is retained by the company in order to help fund future growth, which can increase the value of the shares. |

| What is diversification? |

| International equities |