Cash

Cash is an asset class that everyone thinks they understand until they have to start investing in it.

- Cash is physical and electronic money that you can use for transactions.

- When you invest in cash you may only receive an interest payment because it does not earn a capital return.

- Bank term deposits, credit funds, debentures, mortgage funds, bank bills and negotiable certificates of deposit are all types of cash-based investments.

Cash is the currency notes and coins we carry around in our wallets and purses - or it used to be. Cash now includes not just physical money but electronic money in debit cards and other forms of e-payments. While we cannot earn a return on the cash we have in our hands, we can when the money is in the bank, a fund or in some type of short-maturity bond, for example, one that invests in the money market.

We've all heard the term "cash is king". That's because it is extremely liquid, meaning it can quickly and easily be converted into other assets with almost no probability of capital loss. In fact, sometimes we get discounts by offering to pay for items with cash because the seller gets paid straightaway and there's no possibility of default or a change of mind, and no other charges are involved.

Another feature is that while we've learned in other articles in this edition of The Good Investment Guide that investment returns come from both yield and capital return, with cash there is no capital return - all the return is from its yield or interest rate. But with no capital growth the purchasing power of the initial investment reduces over time due to the effects of inflation.

In order to achieve returns higher than inflation, the after-tax cash rate must be above the inflation rate. This is why cash is considered low risk from a short-term capital preservation perspective, but higher risk over the long term because of the deterioration of the capital value from an after-inflation perspective, particularly if invested in a high tax environment (the tax rate does not take into account the effects of inflation).

The cash yield is based on the short-term interest rate set by a country's central bank - in Australia, this is the overnight money market interest rate set by the Reserve Bank of Australia (RBA). Over time the yield on cash varies in line with RBA monetary policy, with the key characteristics being absolute capital security, high liquidity and variable yield.

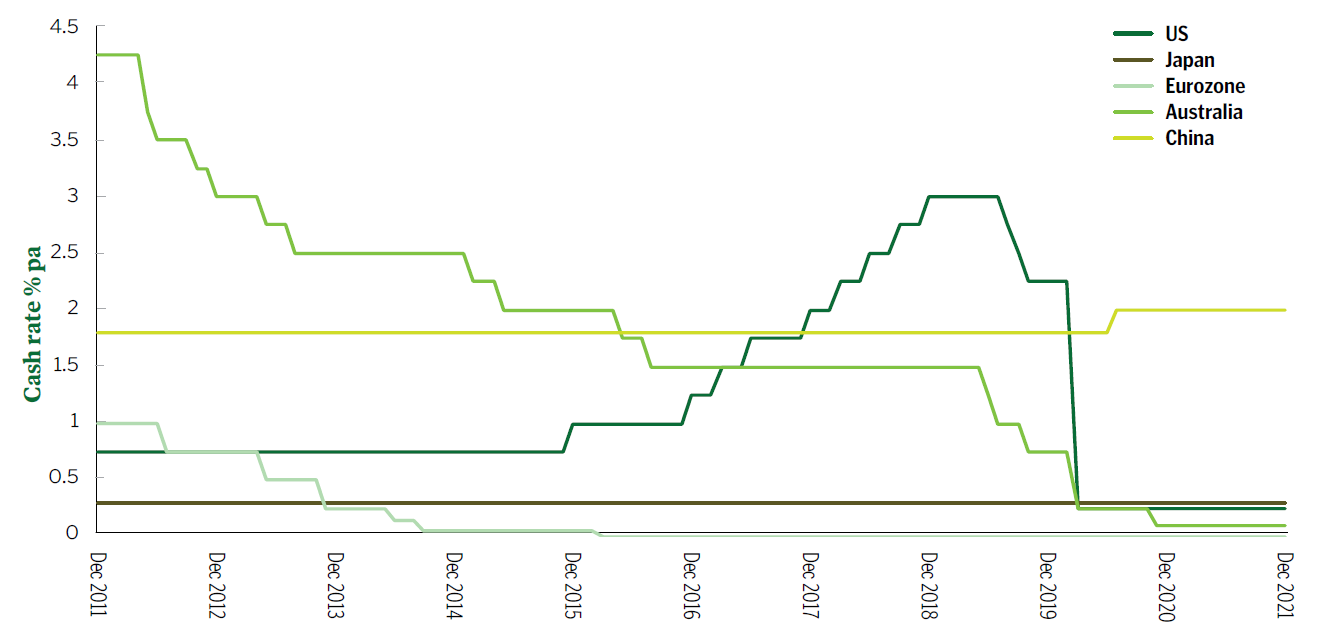

Official cash rates from across the world - December 2021

Source: FactSet

How to invest in cash

There are several ways to invest in cash. The first is straight out cash in the form of notes and coins. There is a cost involved in holding cash - it can be lost or stolen and provides no possibility of yield.

Bank term deposits

Investors can place their money in short-term bank deposits (called term deposits) for periods of up to three years. When they do this they give up liquidity and may suffer a break fee if they decide they need their money earlier than the term stated.

Credit funds

Investors willing to take slightly more risk may wish to deposit their money into a credit fund, which is like a term deposit but the fund is run by a non-bank mortgage lender. Some credit fund operators are highly regarded and quite safe but some are not, so you have to do your research.

Debentures

Debentures are unsecured credit funds offered by private companies. With debentures there is a much higher risk that the operator may not be able to honour your interest rate payments, let alone return your capital. Because these are unsecured, if the company you loaned your money to folds, there is no guarantee you will be repaid.

Mortgage funds

Mortgage credit funds offer yields above that of cash term deposits and most offer daily liquidity. But many of them ran into trouble during the global financial crisis because companies operating the mortgage funds had to sell the funds' underlying properties when their lenders called in their loans. This resulted in affected mortgage funds being frozen and investors unable to access their account.

Cash investment funds

Cash investment funds, which may include cash management trusts, are investment funds operated by some of Australia's biggest investment managers. These funds invest in very high-quality assets like bank bills, negotiable certificates of deposit (NCDs) and term deposits. Some are available as exchange traded funds. The largest of these is more than $1 billion in size.

Bank bills and NCDsBank bills are special securities issued by banks and which are negotiable orders (that is, they can be traded) to pay a certain amount of money at a certain time in the future. They usually mature within six months. Bank bills are 100% guaranteed by the bank issuing the bills. In practical terms, bank bills are discount securities, which means they are issued at a discount to their face value but redeemed at their face value at maturity - in this way, the interest rate is built into the face value price. NCDs are negotiable certificates of deposit. They are similar to bank term deposits but instead of the deposit being recorded in a bank account they are backed by a certificate that can be traded. |

| Fixed income bonds |

| Alternatives |