Indexed investing

Indexed investment management is when the managed fund's investment managers don't try to beat the market but aim to match it.

- Indexed investment managed funds have low costs because they don't try to beat the market but match it.

- The most important decision when choosing an indexed fund is which index you want to follow.

- Many exchange traded funds follow indexed investment strategies.

Indexed managers seek to match the market, rather than outperform it. This is based on the belief that, over the long term, it is difficult to outperform themarket. Indexed managers take the view that asset allocation is the primary influencer of long-term returns for diversified portfolios.

A key advantage of indexed investment managed funds is that they have low costs because managers do not need to research the market to the same extent as active investment managers (the term we use to describe investment managers who do try to beat the market), preferring instead to focus on executing their trades as efficiently as possible. As a result, managed funds using indexed investment management strategies can have very low fees.

Most indexed investment managers follow traditional benchmark indices, such as a bond market index or stockmarket index. These measures are special price-based averages across the stockmarket where larger companies are given a bigger weighting in the index based on the total value of their company (that is, their market capitalisation).

Indexes followed by managed funds

The main way investors compare indexed managed funds is by understanding the market index they follow and their fees, and by examining their tracking error, which is a measure of how closely they replicate that index. As a result, when investors choose an indexed managed fund their most important decision is what index they wish to follow, noting that indexes with similar names can have different calculation methods or can focus on different parts of market.

The most commonly followed index benchmarks associated with managed funds that follow those indexes are described in the table on page 54. New indexes are, however, being developed all the time, for example, special indexes that attempt to follow the infrastructure market or even hedge funds.

Smart beta fundsSmart beta funds are special types of indexed funds that follow more complex composite or hybrid measures, such as an index based on, say, the most profitable companies, companies with the highest sales, companies that are most reliant on overseas revenue, and so on. The term smart beta is based on the word "beta", which analysts use to describe the average return across the market. Smart beta strategies are supposedly cleverer ways for investors to outperform the traditional market. |

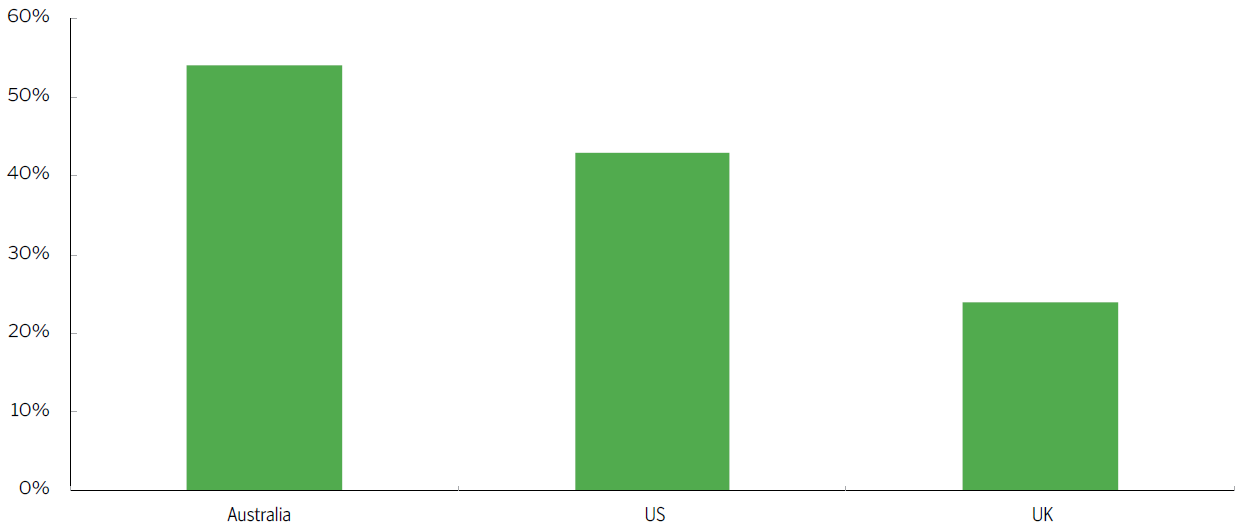

Proportion of investment market that follows indexing

Source: Rainmaker Information

Common indexes used by Australian managed funds

| Asset class | Index |

| Australian equities | S&P/ASX 200 |

| S&P/ASX 300 | |

| MSCI Australian Shares Large Cap | |

| International equities | MSCI World Index |

| S&P 500 | |

| Dow Jones Global Titans | |

| FTSE All-World index series | |

| Property | S&P/ASX 200 A-REIT Index |

| Fixed income | Bloomberg Barclays Global Aggregate |

| Bloomberg AusBond Composite Index | |

| Merrill Lunch US High Yield Master II Index | |

| Cash | RBA Cash Rate Total Return Index |

| Bloomberg AusBond Bank Bill Index | |

Indexed management ≠ Passive managementIndexed investment management is not the same as passive investment management. When an investment manager invests passively they buy a block of company shares, bonds or a property and just leave it in their portfolio. When an indexed investment manager buys shares, bonds or property it is because they wish to match or replicate the market or a particular segment of the market. This leads to the counterintuitive situation where index investment managers are actively deciding which indexes they wish to follow or be exposed to. |

|

Exchange traded fundsAn exchange traded fund (ETF) is a type of investment fund that combines some of the benefits of shares and managed funds. ETFs allow investors to access a portfolio of securities and are traded on the stock exchange. ETF portfolios are designed to replicate particular indexes, such as the ASX 200 or the S&P 500 in the US market. ETF portfolios may include Australian shares, international shares, fixed income securities, listed property trusts, or a combination of asset classes. The price of the ETF reflects the price of the underlying assets, not the demand for the units in the ETF - that is, ETFs are exchangeable on securities exchanges but they are not listed like normal company shares are. The structure of ETFs means they can often operate at lower management expense ratios (MERs) than regular managed funds. For example, while many managed funds may incur average fees of 1.5%, ETFs can operate with average fees of about 0.5%, and some can have fees as low as 0.1%. There are no entry or exit costs other than the broking charges. There are two main types of ETFs:1. Classical ETFs - based on and aim to match the performance of any one of a number of indexes. Classical ETFs use special off-market issue and redemption procedures to increase their attractiveness to institutional investors. 2. Hybrid ETFs - can either be based on an index or can be actively managed by the fund manager selecting the securities that they favour. Hybrid ETFs provide access to a much broader range of asset classes and investment management styles and strategies. The key features and benefits of ETFs are:

|

|

| Investment styles |

| ESG investing |