Investment styles

Investment style is the philosophy behind the investment strategy used by your managed fund's investment manager.

- Investment style is the philosophy behind your investment manager's strategy.

- There are four main styles - value, growth, neutral and indexed.

- Some styles have sub-variants and other styles are known by several terms.

These investment styles can be separated into active styles where the manager tries to outperform the market, or indexed styles where the manager tries to match the market. While investment managers like describing their

investment styles in a multitude of ways, in reality most investment styles can be grouped into four main types, where the first three are active and the fourth is indexed.

Value

Investment managers that use the value investment style try to pick particular investments based on their analysis and judgement rather than the broader momentum of the market. These managers are sometimes referred to as stock pickers because they use their insight and expertise to pick particular stocks that they believe are likely to outperform regardless of the broader economic conditions. This style is sometimes described using the term "bottom-up".

Value or bottom-up investment managers base their judgements on analysis of how stocks rank according to traditional valuation methods, such as price to earnings (p/e), price to book value, price to net tangible asset backing (breakup value) and dividend yield. While value managers will still assess the growth potential and barriers to entry that a company may benefit from, the valuation factors dominate the investment screening and ranking process.

Value investors look for shares that are cheap relative to what the investor considers fair value. This might occur, for example, when an overall industry is struggling or in decline. While the prices of all companies in that industry fall, there might be some standout companies that investors have overlooked in their rush to exit all companies involved in that industry. Value investors step in when prices have fallen and take a long-term view that the company or industry will recover.

Growth

The growth investment style is sometimes referred to as momentum or thematic because investment managers that follow it seek to invest in stocks and securities that exhibit strong growth tendencies either in themselves or because the market is going through a growth phase.

These managers will analyse growth in profits, earnings and sales by focusing on industry factors, as well as barriers to entry for new entrants, the pricing power of the company and other factors that allow a company to sustain increasing profit margins. Broadly speaking, growth factors will dominate the investment screening and ranking process.

Growth investing is about investing in firms that are growing quickly. The companies may have low dividend yields because they reinvest nearly all their earnings in order to fund future growth. Growth companies are perceived as innovators. The companies may appear expensive based on their current earnings, but the investor predicts that future growth will make today's price look cheap in retrospect. The risk with these companies is that their growth rate may slow and the current high prices are not justified. Another risk is that expectations of future growth are built on false (or changing) assumptions or that the company mismanages its growth.

There are two variants of growth investing: momentum and market capitalisation.

The momentum investment style refers to the buying and selling of securities within shorter time periods, often by taking advantage of short-term price movements. Investment managers following a momentum style seldom do long-term in-depth analysis, relying instead on computer algorithms to make decisions for them based on price patterns, "moving averages" and differences in price based on similar securities. These investors often use what is called technical analysis, which involves charts using price and volume to pick turning points.

The market capitalisation investment style refers to the belief that certain segments of the stockmarket provide higher risk-adjusted returns than others. This may be because that segment suits their investment style. For example, many small cap investment managers believe that the segment is underresearched, which means there are potential bargains for active managers. Others believe large cap stocks provide higher returns because larger companies can be run more efficiently and there are barriers to entry in their particular industries.

Neutral

The neutral investment style is neither value nor growth. It seeks to avoid the strong biases that can be exhibited by these managers, aiming instead to add value regardless of which style of investment is in favour. These managers can have both valuation and growth factors within their screening and ranking. Despite a manager having a neutral style tendency, the investment process often leads to a portfolio with a slight bias towards value or growth.

Indexed

Indexed managers are those that don't try to outperform the market, but seek only to match it. They adopt this style because they believe that over the long term it is inherently difficult to outperform the market, a view supported by the finding that asset allocation is a more important influencer of long-term returns for diversified portfolios.

Indexed management also has the advantage of being much cheaper to implement because managers do not need to research the market to the same extent, preferring instead to put their energies into executing their trades as efficiently as possible.

While most indexed investment managers follow traditional measures such as the stockmarket index or a bond market index, they can also follow composite hybrid measures, such as an index based on, say, the most profitable companies, companies with the highest sales, companies that are most reliant on overseas revenue, and so on. Indexed managers should not be confused with passive investment strategies or styles, where an investment is placed and just left for the long term. Indexed management is about matching the market index as cost effectively as possible.

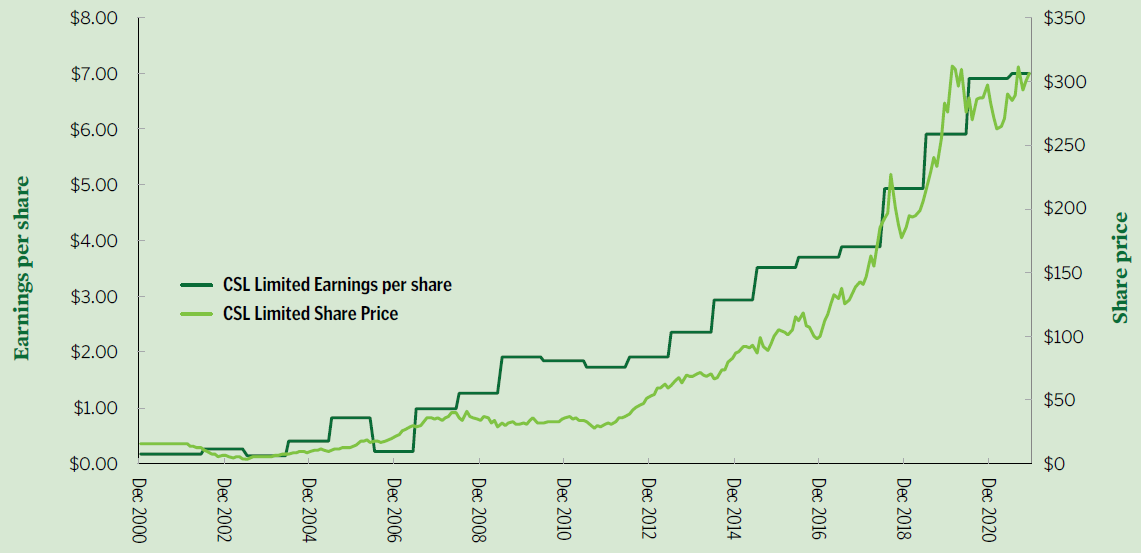

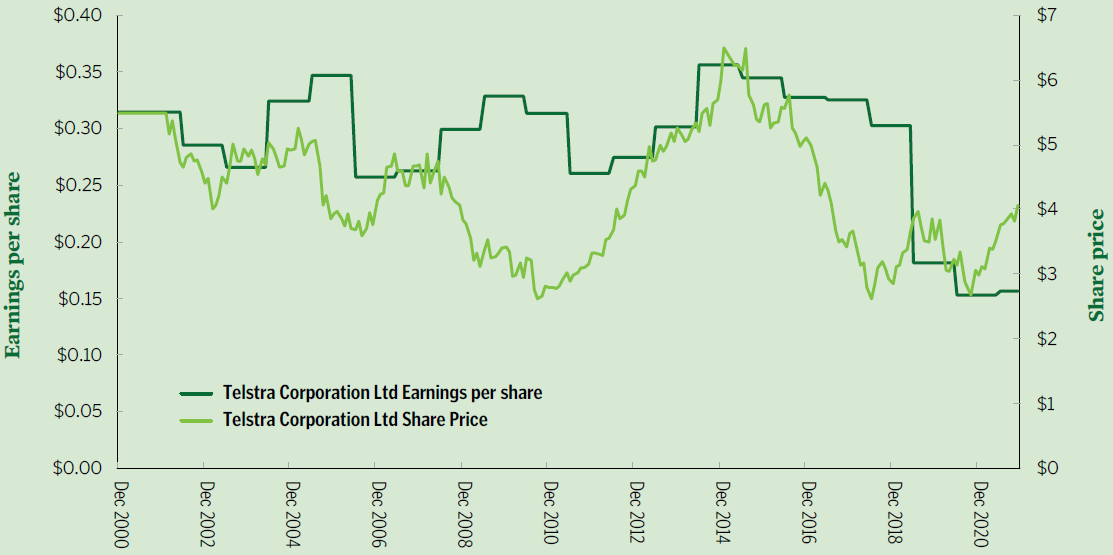

Value versus growth - two examplesThe following charts demonstrate the difference between value and growth investing. The growth manager is looking for companies that will grow in earnings, with the price reflecting that growth. CSL Limited, which was privatised in 1994, is a great example of a growth stock. In the past 20 years earnings per share has grown from 14 cents per share in December 2000 to $6.91 in December 2020 - a growth rate of 22%pa. In that time the share price rose from $13 to $283 - a growth rate of 17% a year (this does not include dividend payouts). Telstra Corporation Limited, on the other hand, is a good example of a value stock. It began the period with a share price of $6.43 and 20 years later was worth $2.98 a share - a negative return of 4% a year. Earnings per share fell from 29 cents per share to 15 cents per share. CSL is a good example of a growth stock

Telstra is a good example of a value stock

Source: FactSet |

| Alternatives |

| Indexed investing |