Property

Property is all around us in the form of office buildings, factories, retail outlets, hospitals and farms. It is an attractive asset class because it has both growth and income characteristics.

- The property investment market is separated into property that is directly held by the investor and property that is held through trusts.

- The main property segments are industrial, offices, hotels and leisure, and retail.

- Property has some of the highest yields available in the investment market.

Managed funds invest into property in one of two ways. They buy real property assets, known as direct property, or they buy shares in investment companies or units in other funds that own direct property. Either way, the underlying assets are the same asset class and should exhibit the same investment returns and risk characteristics. The total value of these listed and unlisted property trusts in Australia is around $250 billion. The main types of property for investment purposes are:

- Offices - medium-to-large-scale office buildings in and around regional centres and major cities.

- Industrial properties - warehouses, factories, storage facilities and industrial parks.

- Hotel and leisure properties - hotels, cinemas and theme parks.

- Retail properties - shopping centres, shopping malls and large stand-alone outlets.

Property trusts

While many Australians invest directly into the property market by holding residential property for rent, it is easier, cheaper, more liquid and geographically diverse to invest through a managed investment trust. These

trusts are usually listed on the ASX and are called real estate investment trusts (REITs).

Investors can also buy units in property investment trusts that are not listed on the ASX. These are called unlisted trusts.

Both REITs and unlisted trusts hold direct property. It's just that the trust itself may be listed - this distinction can be ambiguous because unlisted property can sometimes also be called direct property even though the

investors are buying units in the trust rather than being direct owners of the commercial property inside the trust.

There are 20 A-REITs listed in the S&P/ASX 200, with a market capitalisation of around $150 billion. This represents around 7% of the value of the S&P/ASX 200 at December 2021. To put this in perspective, the top four Australian banks represent around 16% of the Australian sharemarket, meaning AREITs represent only about one half the valuation of the banking sector.

A-REITs can be one of the higher-returning sectors of the stockmarket, although they are subject to periodic volatility in their capital values. They are one of the highest-yielding investment sectors available, explaining why property trusts are so popular. This is on top of their capital appreciation, which is determined by the traded price of the units in these REITs on the ASX. Expected capital growth of property is less than investors expect for listed equities because less of the trust's income is retained for reinvestment.

A-REITs pay out at least 100% of their entire taxable income to unit holders. This means they do not have to pay tax themselves. Some REITs pay out more than 100% of their taxable income as their cashflow often exceeds their taxable income due to deductions for depreciation and building expenses. Distributions can take the form of regular income or tax-deferred income, where the value of the distribution is deducted from the initial capital cost of the investment.

It is also possible to invest in international or global REITs through managed funds specialists in the property asset class - these may be referred to by their acronyms I-REITs or G-REITs.

Unlisted and hybrid property trusts

Unlisted trusts directly own a portfolio of real estate assets and are not listed on the ASX. Many hold capital raisings before they purchase portfolios and only expect to exist for a limited time before returning capital (and profits) to investors. Others exist in perpetuity. The costs of buying into and selling out of unlisted trusts is much higher than for funds that invest in REITs. This ensures that investors tend to stay invested in unlisted property trusts for longer. Unlisted funds may also change the terms of applications and redemptions to ensure that properties are not sold at inopportune times just to meet redemption requests.

There is also a hybrid form of trust that invests in both listed property trusts and direct property. These funds have some of the liquidity associated with REIT funds with the benefits of owning and managing properties directly.

Returns from unlisted trusts come from yield and changes in their capital valuation. One of the key differences between listed and unlisted trusts is that the price of unlisted trusts is determined by property experts who conduct periodic valuations of all the trust's assets, whereas the valuation of a REIT is determined by the price other investors on the ASX are prepared to pay for shares in the REIT. This is one of the reasons why unlisted trusts can have less volatile returns than REITs.

What determines a property's value?The value of the property is determined by the current rental yield and the potential for increasing rents in the future. This includes the types of amenities on offer, location, how new the building is or how long it has been since the last refurbishment. It will include the composition of tenants. Single tenants with long leases may be attractive, while short remaining leases may mean that the property may have trouble attracting new tenants. Returns from property are tied up with the supply of similar properties and overall demand in the economy. Oversupply forces rents and property values lower. Due to the cost and time of obtaining land, securing permits and building property, a booming economy may create demand that cannot be met with the existing supply, thus leading to higher prices. Property's investment characteristicsThese factors lead to property having unique characteristics that make it different from other asset classes. It is specific to a location, requires maintenance to ensure its continuing usefulness to tenants, is illiquid (meaning it can take a long time to buy or sell), and is subject to high transaction costs. As a result, property is considered to have a moderate level of risk, that is, lower investment risk than equities but higher risk than fixed-interest bonds. |

Making money from property funds

The main way managed funds make money from investing in property is by earning rental income. They should also make capital gains as the property increases in value either through the forces of supply and demand or through building upgrades.

This means a managed fund's investment returns from property comes in two parts: from income and capital growth. Think of this as similar to how managed funds make money from investing in equities: from company dividends as well as from the increase in share prices.

In this way, rental income is similar to interest payments on a bond or fixed-interest investment, for example, a bank term deposit. Both are calculated as a yield (percentage return) on the capital value at the time the lease was signed or the bond was issued. When a property tenant takes out a lease they do so for a certain period of time and pay rent based on a formula that may include allowances for rent increases due to factors such as inflation or their business turnover.

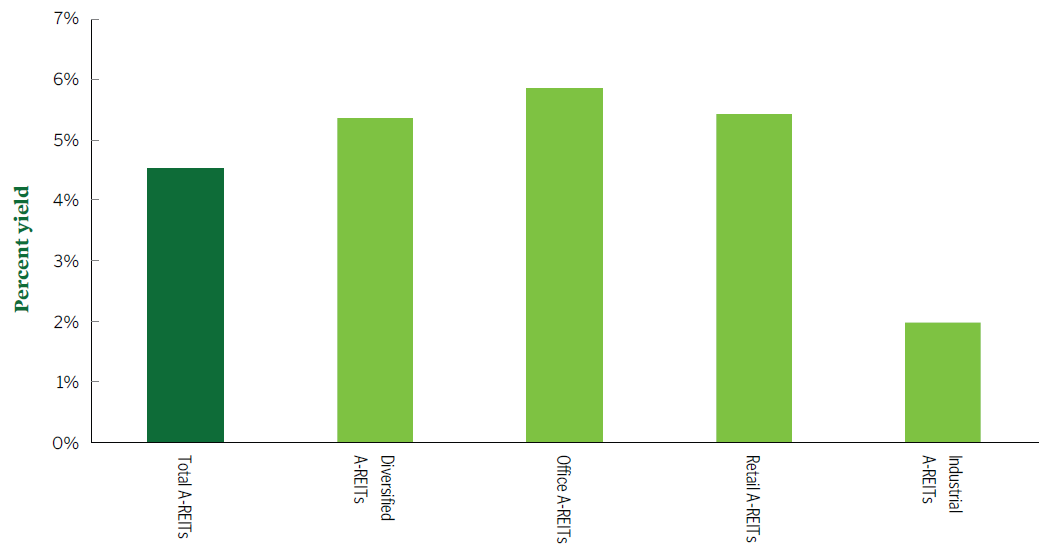

Yields and capital returns available from different segments of the property market are detailed in the table below.

ASX REIT sectors and their yields - 2021

Source: FactSet and Rainmaker Information

Overview of S&P/ASX 200 Australian REIT sector at December 2021

| Value | Number of REITs | 12-month yield | 12-month capital return | 12-month total return | |

| S&P/ASX 200 / A-REIT | $148,613 | 21 | 4.5% | 21.6% | 26.1% |

| S&P/ASX 200 / Diversified A-REIT | $49,562 | 8 | 5.4% | 16.3% | 21.7% |

| S&P/ASX 200 / Office A-REIT | $13,190 | 2 | 5.9% | 15.8% | 21.6% |

| S&P/ASX 200 / Retail A-REIT | $33,403 | 7 | 5.4% | 9.7% | 15.2% |

| S&P/ASX 200 / Industrial A-REIT | $47,306 | 2 | 2.0% | 39.9% | 41.9% |

Source: FactSet, Rainmaker Information

| International equities |

| Fixed income bonds |